Trump's EU Wine Tariffs: Latest Developments & Impact - What's Next?

Could a 200% tariff on European wines, champagnes, and alcoholic products truly reshape the landscape of the global drinks market? President Donald Trump's recent threats to impose such duties on goods imported from the European Union have sent shockwaves through the industry, raising concerns among producers, distributors, and consumers on both sides of the Atlantic.

The potential economic ramifications are substantial. This move, if enacted, would represent a significant escalation in trade tensions between the United States and the EU. The brewing conflict, if materialized, would directly affect the import and export of a wide range of products. President Trump's pronouncements have specifically targeted wines, champagnes, and other alcoholic beverages, sparking alarm among European and American producers. This situation has the potential to disrupt global supply chains and impact consumer choices. The core of the issue appears to be retaliatory tariffs, with each side responding to the other's trade policies with increasingly stringent measures.

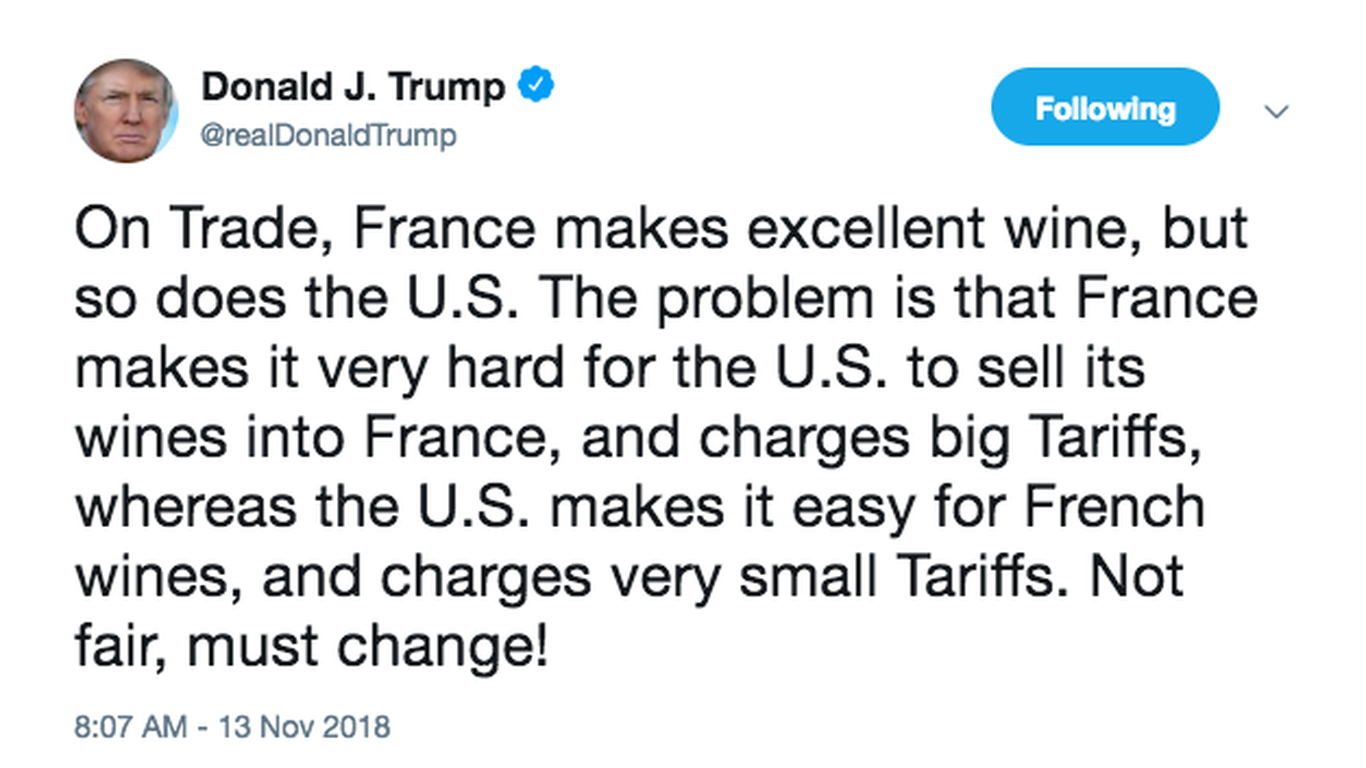

The core of the dispute revolves around trade practices and perceived unfairness. The former U.S. President, in his recent statements, has accused the EU of employing "hostile and abusive" taxing and tariffing practices. This has led him to threaten significant tariffs on European products, particularly alcoholic beverages. The EU, in turn, has voiced its concerns and has hinted at retaliatory measures of its own. The trade disputes have far-reaching implications, potentially affecting a wide array of industries beyond just wine and spirits. The escalation could lead to higher prices, reduced consumer choice, and a broader slowdown in international trade.

The United States, in the past, has imposed tariffs on steel and aluminum imports from the EU, leading to retaliatory measures from the European side. The present situation is another turn in the ongoing trade war. The impact could be felt across the entire market and will have significant effect.

The potential for significant disruption is heightened by the structure of the wine and spirits industry. It involves complex global supply chains, with goods moving across multiple borders before reaching consumers. The prospect of drastic tariffs will disrupt these intricate structures. Distributors who manage these global supply chains will face a daunting task, potentially needing to rework their networks and business models to accommodate the new tariffs. The implications extend to retailers and consumers. The added cost of tariffs can translate to higher prices on store shelves, potentially causing a decrease in the demand for some products. The change would inevitably affect consumer purchasing behavior. It's a situation filled with uncertainty, where the immediate consequences are difficult to precisely predict.

Ben Aneff, the managing partner of Tribeca Wine Merchants and also President of the U.S. Wine Trade Alliance, has issued a warning about the impact these tariffs would bring, stating that such duties could severely disrupt this structure. The U.S. Wine Trade Alliance, with its network of members throughout the country, has a keen understanding of the potential effects of any trade disputes. The U.S. wine distributors and producers are already showing their wariness regarding the possible effects of these new tariffs. Their concerns will shape the responses of the industry.

The impact of such tariffs is projected to be quite extensive. In order to gain an idea of the level of trade involved, consider that the U.S. imports over $600 billion worth of goods from Europe. The imposition of new tariffs will most likely hit some of the most popular categories the hardest. The consequences of the trade disputes are multi-layered and widespread.

It is important to note the difference between the current proposals and other ongoing trade disputes. For example, tariffs on goods from China are also in the news, though the terms involved are different. Tariffs on goods from China could fall from 145% to a range of 50% to 65%, according to the Wall Street Journal. This represents a shift in trade policies and is very important. In contrast, the proposed tariffs on EU wines and spirits are an increase to 200%. This creates a different degree of economic pressure and market changes.

The reactions to the tariffs vary. While the Trump administration claims the tariffs would benefit the domestic wine industry, the domestic wine industry disagrees. The Wine Institute, representing California winemakers, says that these tariffs will hurt the wine sector, including farmers, vintners, distributors, retailers, and the millions of people working across the supply chain. This divergence of opinion highlights the complexity of the issue. This means there will be much discussion over these trade disputes.

The trade tensions between the U.S. and the EU are multifaceted. In the past, Canada and the EU swiftly hit back at the increased steel and aluminum tariffs imposed by the U.S. on their goods. The retaliatory measures have the potential to escalate the conflict, with consequences felt around the world. The outcome will involve a variety of actors and interests.

One voice in the industry, Ms. Taylor, who brings in 2 million bottles a year, weathered the 25% tariff Trump put on certain EU bottles during his first term. She expanded her distribution in Europe to mitigate the effects. But, as she stated, a 200% tariff is a completely different scenario. The substantial increase in the duty rate will severely hinder businesses. Her experience with prior tariffs provides an important reference point. The industry is bracing for significant changes.

In his recent communications, President Trump has emphasized the need for trade adjustments, with the aim of correcting perceived imbalances. His statements reflect a consistent theme of advocating for protectionist measures. On Thursday morning, the former president posted on Truth Social that if the EU didn't remove a 50% tariff on whiskey, the U.S. would place a 200% tariff on wine, champagne, and other alcoholic products. The explicit warning shows his perspective on the ongoing trade disputes.

The current political atmosphere adds a layer of uncertainty to the situation. Without a new deal or an extension, the existing duties will snap back into force at an even higher rate. This is another complication that has the potential to affect the market. The clock is ticking and the industries are watching to see what will happen in the near future.

The threat of these tariffs follows on the heels of other trade discussions. These tariffs are another escalation in a growing trade dispute that could affect the global market.

The potential impact of the tariffs reaches far beyond the immediate economic considerations. The trade war could change relationships between nations. Any shift in international cooperation could have far-reaching consequences for a wide variety of sectors.