Drake Tax Software: The Complete Professional Tax Solution - Get Started!

Are you a tax professional seeking software that simplifies complex tax preparation while empowering your business growth? Drake Software stands as a complete, professional tax preparation program, consistently voted #1 by professional preparers, offering a comprehensive solution for federal, state, business, and individual returns.

In the ever-evolving landscape of tax preparation, choosing the right software can make or break your tax season. Drake Tax emerges as a formidable contender, a complete and professional tax software designed to cater to the diverse needs of tax professionals. With the ability to handle any tax return, whether personal or business, federal or state, Drake Tax positions itself as a versatile solution for the modern tax preparer. The software's comprehensive nature is underscored by its inclusion of everything needed for filing individual and business returns in 48 states and the District of Columbia, a testament to its broad applicability.

Here's a breakdown of key features and functionalities, offering a glimpse into the capabilities of Drake Tax:

| Feature | Description |

|---|---|

| Comprehensive Tax Preparation | Handles federal and state returns, encompassing both individual and business tax filings. |

| State Coverage | Supports tax filing in 48 states and the District of Columbia. |

| Business Support | Includes features to manage and file business tax returns. |

| Ease of Use | Designed with user-friendliness in mind, making it accessible for both seasoned professionals and those new to the field. |

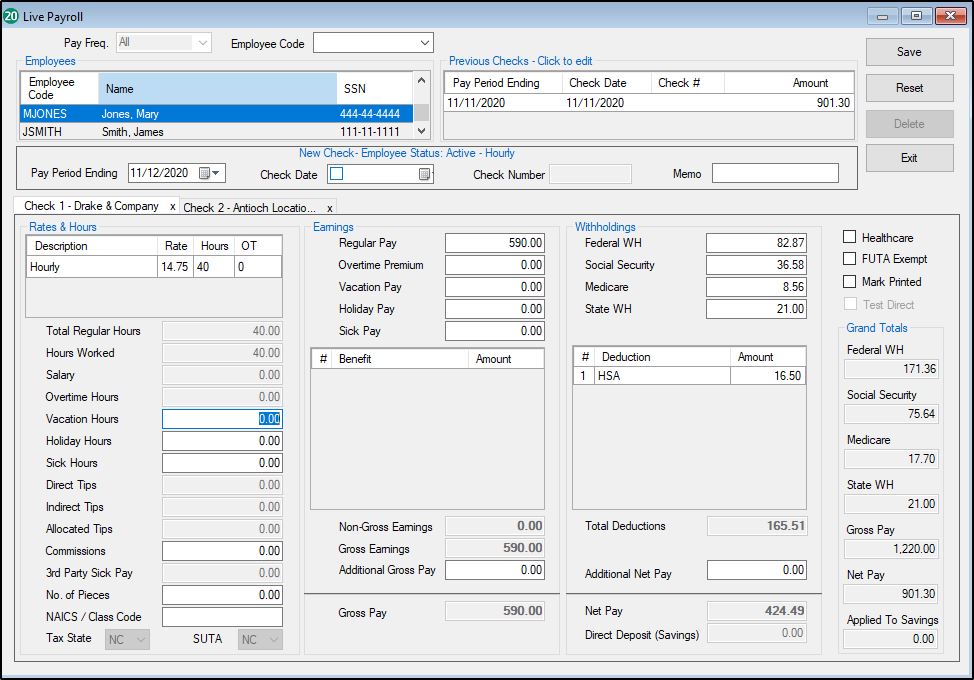

| Client Management | Offers tools to track and analyze demographics, return status, payments, and billing information. |

| Document Archiving | Provides a virtual filing cabinet, enabling return archiving and source document storage through Drake Documents. |

| Bank Products | Integrates the ability to offer bank products, providing clients with options for refund disbursement and fee payment. |

| Customer Support | Offers customer support to assist users with any software-related issues or questions. |

| Training and Resources | Provides training resources, including webinars and short instructional videos, to enhance user proficiency. |

Drake Tax isn't just a software; it's a comprehensive ecosystem designed to support tax professionals at every stage of their practice. The company, established in 1977 with its headquarters in Franklin, North Carolina, has a rich history in the tax preparation software industry.

The availability of single-user versions, specifically Drake Tax Pro and Drake Tax 1040, caters to businesses with a single tax return preparer. The software ensures full tax compliance, much like Drake Zero and Web1040, while also including the functionality to file business tax returns. A key aspect of Drake Tax is the inclusion of Drake Documents, a virtual filing cabinet that offers return archiving, source document storage, and more. It is included at no extra cost, adding to the software's overall value. Drake software customers can easily download and install available versions of Drake Tax (federal and state programs) through the drake download center, enabling seamless updates and access to the latest features.

For those considering Drake Tax, the company encourages prospective users to explore its offerings through trial versions, demos, and webinars. This allows tax professionals to familiarize themselves with the software's functionality before making a commitment. The company also provides live sales webinars, which offer an overview of customization, navigation, and electronic filing, along with special topic presentations covering key tax industry issues. Furthermore, Drake offers everything you need to offer bank products, a popular and easy way to add revenue to your tax season, while giving your customers options to receive their refund and pay fees.

The Drake tax software consistently includes key updates with each new release. State programs are available on the january release of drake tax. Once available, states can be installed during installation of the software or, from tools menu in the software. For more information, download the fact sheet for your state.

Drake provides the tools and support tax professionals need to build their businesses and attract new clients. See why professional preparers vote drake #1 year after year.

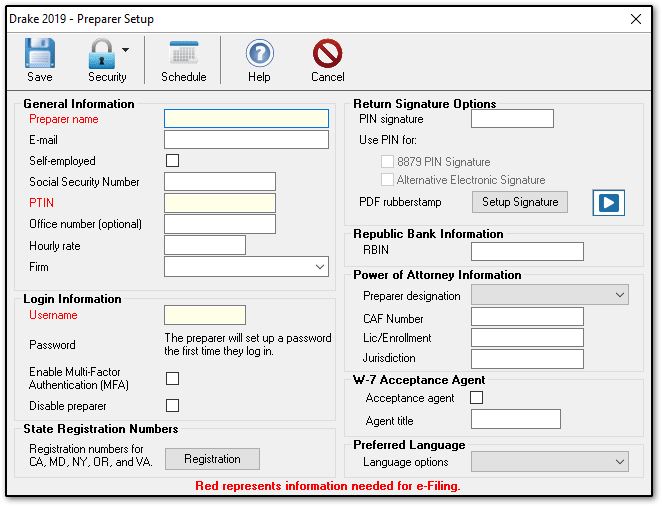

If you're considering drake tax as your tax preparation software, you may benefit from attending one of our software seminars.The single user versions of drake tax pro and drake tax 1040 are for businesses with one tax return preparer (ptin holder) only.Anyone with a ptin who prepares or substantially aids in preparing tax returns is considered a tax preparer and is counted as a user.

Drake tax online tm provides full tax compliance like drake zero and web1040, with the added capability to file business tax returns.Enrollment subject to eligibility and approval.Infinicept terms and conditions apply.Registration with protection plus required.You may be contacted directly by protection plus.Drake software is not a party to any transactions you may choose to enter into with protection plus.Protection plus terms and conditions apply.

Drake documents is your virtual filing cabinet, providing return archiving, source document storage, and more.Included free with drake software.Drake software customers can download and install available versions of drake tax (federal and state programs) through the drake download center.Try it free, watch demos, view webinars, and learn about drake's products, pricing, and service and support.The single user versions of drake tax pro and drake tax 1040 are for businesses with one tax return preparer (ptin holder) only.Anyone with a ptin who prepares or substantially aids in preparing tax returns is considered a tax preparer and is counted as a user.The single user version is limited to one user.Learn how to download and install drake tax (federal and state programs) from the drake software support website.Follow the steps to enter your account and serial number, choose the tax year, and run the installation wizard.Find answers to common questions and issues about drake tax and drake accounting software products.Learn how to use the drake tax trial software to test its functionality and convert from another program.Learn about the new features and changes in drake tax 2024, the tax preparation software for tax professionals.

Track and analyze demographics, return status, payments, billing information, and more.Set up a custom chart of accounts, import from an existing client, or use a template.During setup, change account information as needed, add account levels, enter current budget, starting balances, and export to drake tax.

As part of our commitment to provide you with reliable software and support, we have consistently included key updates with each new release of drake tax.Our live sales webinars on tuesdays provide an overview of customizing, navigating, and electronic filing with drake tax.On thursdays, our sales team presents special topics covering key tax industry issues and solutions from our own drake software experts and industry partners.Drake provides everything you need to offer bank products, a popular and easy way to add revenue to your tax season, while giving your customers options to receive their refund and pay fees.State programs are available on the january release of drake tax.Once available, states can be installed during installation of the software or, from tools menu in the software.Drake professional tax software has maintained a reputable position in the professional tax preparation industry for several years.The company was established in 1977, with its headquarters in franklin, north carolina.Learn the basics of drake tax with these short instructional videos.Content with closed caption [cc] enabled is available by clicking [cc] in the video or its summary.Drake accounting is available in two versions:Forms edition and professional edition.Drake provides the tools and support tax professionals need to build their businesses and attract new clients.Drake documents is your virtual filing cabinet, providing return archiving, source document storage, and more.Included free with drake software.

The software also offers the option to set up custom charts of accounts and import data from existing clients. During setup, users can modify account information, add levels, enter budgets, and manage starting balances. The software is designed with integration in mind, facilitating seamless data transfer to and from Drake Tax.

Customer testimonials highlight the impact of Drake Tax. One user, John Weitz, expressed his gratitude for switching to Drake Tax, praising its reasonable pricing and outstanding customer support. He emphasized how the software and support team made his job as a tax preparer much easier, providing the essential tools for a successful tax season. Another benefit is the easy to use interface and regular updates.

Drake tax professional tax software has maintained a reputable position in the professional tax preparation industry for several years.

The company was established in 1977, with its headquarters in franklin, north carolina.