Explore Drake Tax Software: Features, Training & More

Is efficiency and precision paramount in your tax preparation endeavors? Drake Software, a comprehensive tax preparation program, is meticulously designed to streamline your workflow and empower you to serve your clients with unparalleled effectiveness.

The landscape of tax preparation is constantly evolving, demanding tools that not only meet but exceed the expectations of both tax professionals and their clients. In this environment, the choice of software is not merely a matter of convenience; it is a strategic decision that directly impacts the success and growth of a tax practice. Drake Software emerges as a frontrunner, offering a robust suite of features and functionalities tailored to meet the multifaceted demands of modern tax preparation.

Drake Software's reputation is built upon its completeness, its professionalism, and its commitment to providing a comprehensive solution for all tax preparation needs. It's not just software; it's a complete ecosystem. With Drake Tax, tax professionals can tackle any return, be it personal or business, federal or state, with confidence and precision. The softwares design philosophy centers around user experience, ensuring that every feature contributes to a more efficient and streamlined workflow.

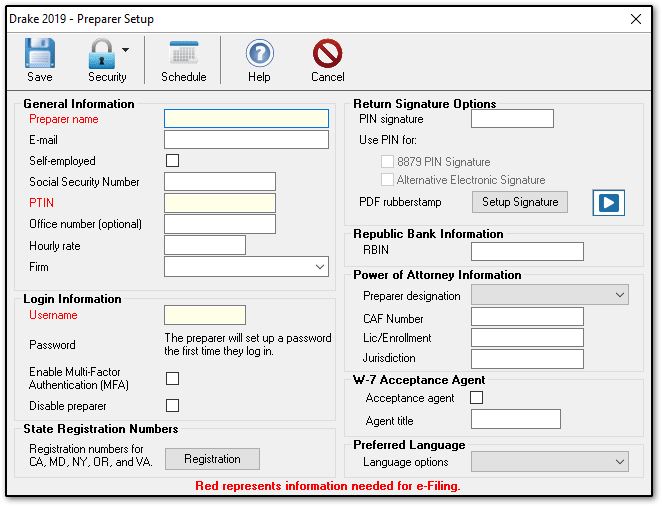

The software's ability to handle both federal and state returns, along with its support for various business and individual tax scenarios, marks it as a versatile tool. For tax preparers, this means the ability to work with a wider range of clients and a greater degree of specialization. The software is designed with the aim of making the process more user-friendly and intuitive. The software's capacity to manage user accounts with ease, alongside the straightforward download and installation procedures through the Drake Download Center, is a testament to its commitment to user-friendliness.

Drake Software is not just about the core functions of preparing tax returns; it also provides extensive support and resources. From the frequently asked questions (FAQs) section, designed to offer instant solutions to common issues, to a wealth of resources aimed at helping users get the most out of the software suite, Drake Software goes above and beyond.

Training is a critical component of the Drake Software ecosystem. With comprehensive training courses led by industry experts like Ann Campbell, CPA, and Bethany Virga, users can gain valuable insights, enhance their skills in advanced tax topics, and potentially earn up to 16 CPE hours. This level of training support ensures that users are well-equipped to leverage the full potential of Drake Tax, thereby maximizing their practice efficiency. The program caters to all skill levels, ensuring everyone can benefit.

The software's commitment to continuous improvement is evident in its updates and enhancements. Many of the changes throughout the past year have been dedicated to improving the user experience, making Drake Software an even more user-friendly, efficient, and comprehensive product suite. The ability to renew the software online using a credit or debit card highlights Drake Software's commitment to accessibility and convenience.

The software's analytical tools, allow users to track and analyze demographics, return statuses, payments, and billing information, giving professionals better insights into their practices performance. The softwares features extend to helping users navigate the complexities of financial data and reporting.

Drake Software's integration with Protection Plus and Infinicept reflects its commitment to offering a comprehensive suite of services. While Drake Software is not directly involved in transactions related to these services, its integration of third-party offerings demonstrates its holistic approach to serving the needs of tax professionals.

The availability of state programs on the January release of Drake Tax, followed by easy installation through the software's tools menu, showcases the software's ability to adapt to the dynamic tax landscape. The inclusion of features like customizable cabinets, drawers, and folders for document organization, along with compatibility with Drake Portals (SecureFilePro) for client file exchange and offsite backup, indicates the software's focus on facilitating seamless workflows and secure data management.

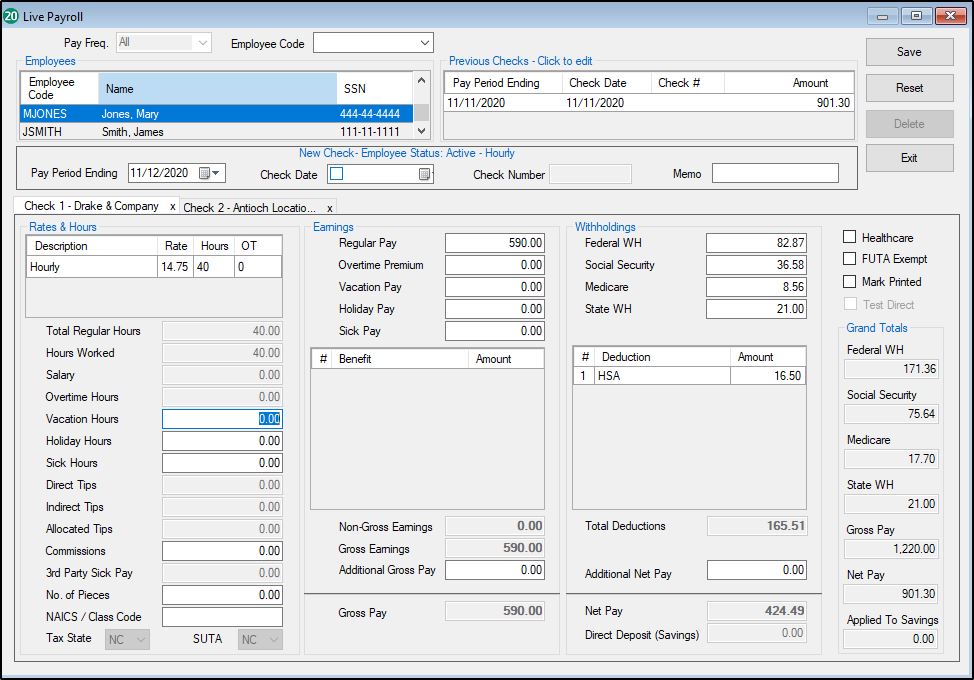

The Drake Professional Tax Softwares longevity in the professional tax preparation industry since 1977, with headquarters in Franklin, North Carolina, reflects its steadfast commitment to quality and its understanding of the industry's nuances. The availability of training resources, like short instructional videos and content with closed captions, underlines Drake Softwares dedication to making its products accessible to all users. The two versions of Drake Accounting, Forms Edition and Professional Edition, offer further flexibility to meet diverse needs.

Key Features of Drake Software:

- Complete professional tax preparation for federal and state returns, business and individual.

- Streamlined workflow and enhanced efficiency.

- Powerful features that allow you to focus on serving clients and growing your practice.

- Easy user account management.

- Comprehensive support and resources, including FAQs and training courses.

- Online renewal options.

- Analytical tools for tracking and analyzing data.

- Integration with third-party services like Protection Plus and Infinicept.

- State program availability and easy installation.

- Document organization and client file exchange features.

Drake Tax offers a robust solution for tax professionals, incorporating features that streamline workflows, enhance efficiency, and promote client service. The software emphasizes the user experience, providing comprehensive resources and ongoing support to help tax preparers maximize their practice's potential.

The softwares dedication extends to making sure users have the knowledge and skills to maximize the software. Training courses featuring industry experts like Ann Campbell, CPA, and Bethany Virga, provide comprehensive insights into Drake software. These courses not only enhance practical skills but also offer opportunities to earn CPE hours, underscoring the softwares commitment to professional development. The software includes many versions that are tailored to diverse skill levels, providing a comprehensive tax preparation suite.

The convenience of online software renewal, coupled with features such as tracking and analyzing demographics, return statuses, payments, and billing information, gives tax professionals deeper insight into their practices performance. The software's incorporation of advanced analytics provides valuable data for strategic decision-making, contributing to the overall success of the practice.

The software's integration with third-party services like Protection Plus and Infinicept illustrates its dedication to providing a complete range of services. While Drake Software remains impartial to transactions with these partners, its support of such collaborations expands its ability to fulfill the varied needs of tax professionals. State program availability and easy installation is another key aspect.

Drake Software continues to be a valuable tool for professionals by offering ongoing support, updates, and resources, and its ability to provide state programs, convenient access, and a user-friendly environment. For professionals in the tax preparation sector, it's an essential tool.