EBITDA & EBIDA: Understanding Profitability Metrics

Is EBITDA the ultimate measure of a company's financial health? While widely utilized by analysts, its significance warrants a deeper, critical examination.

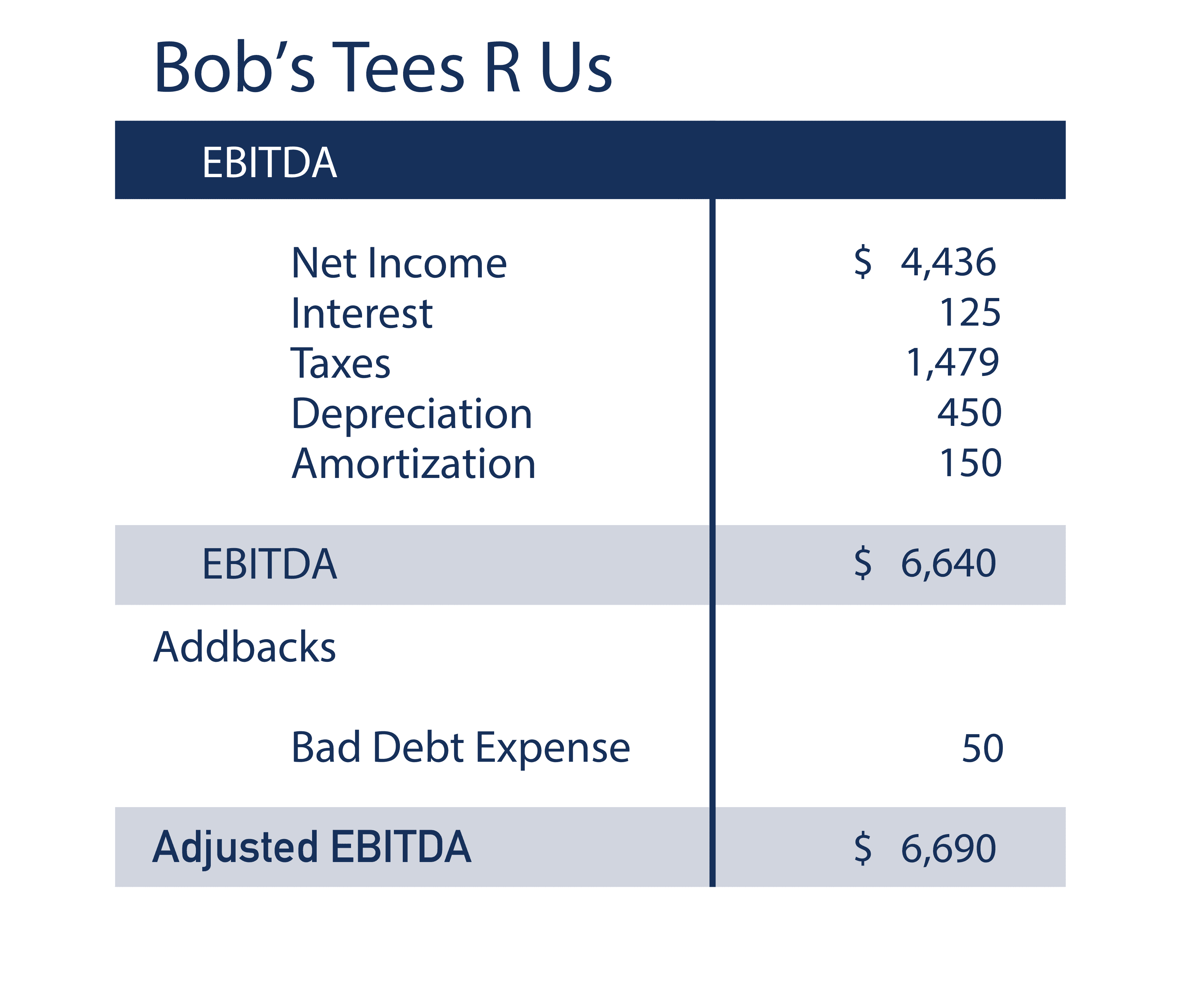

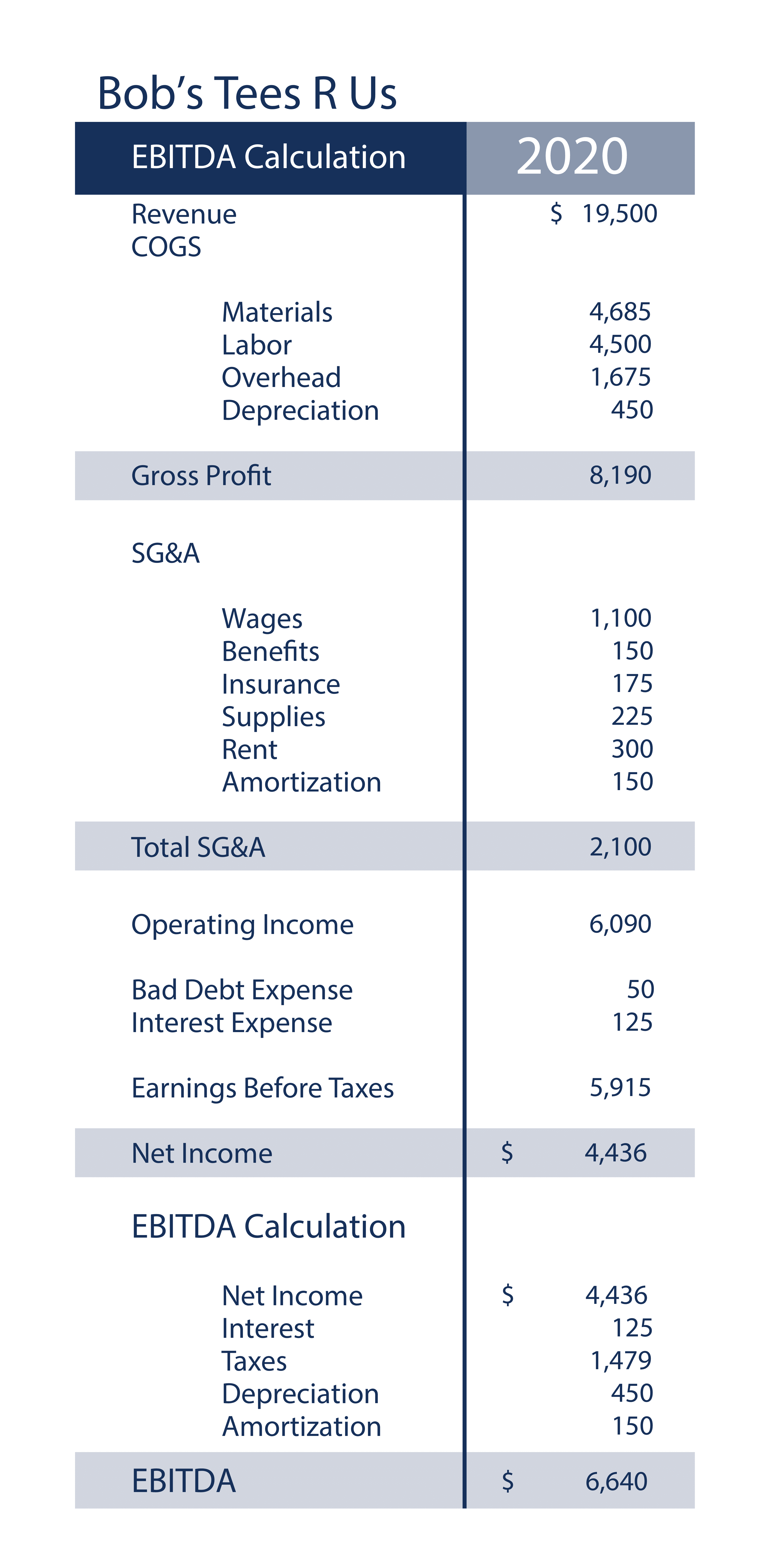

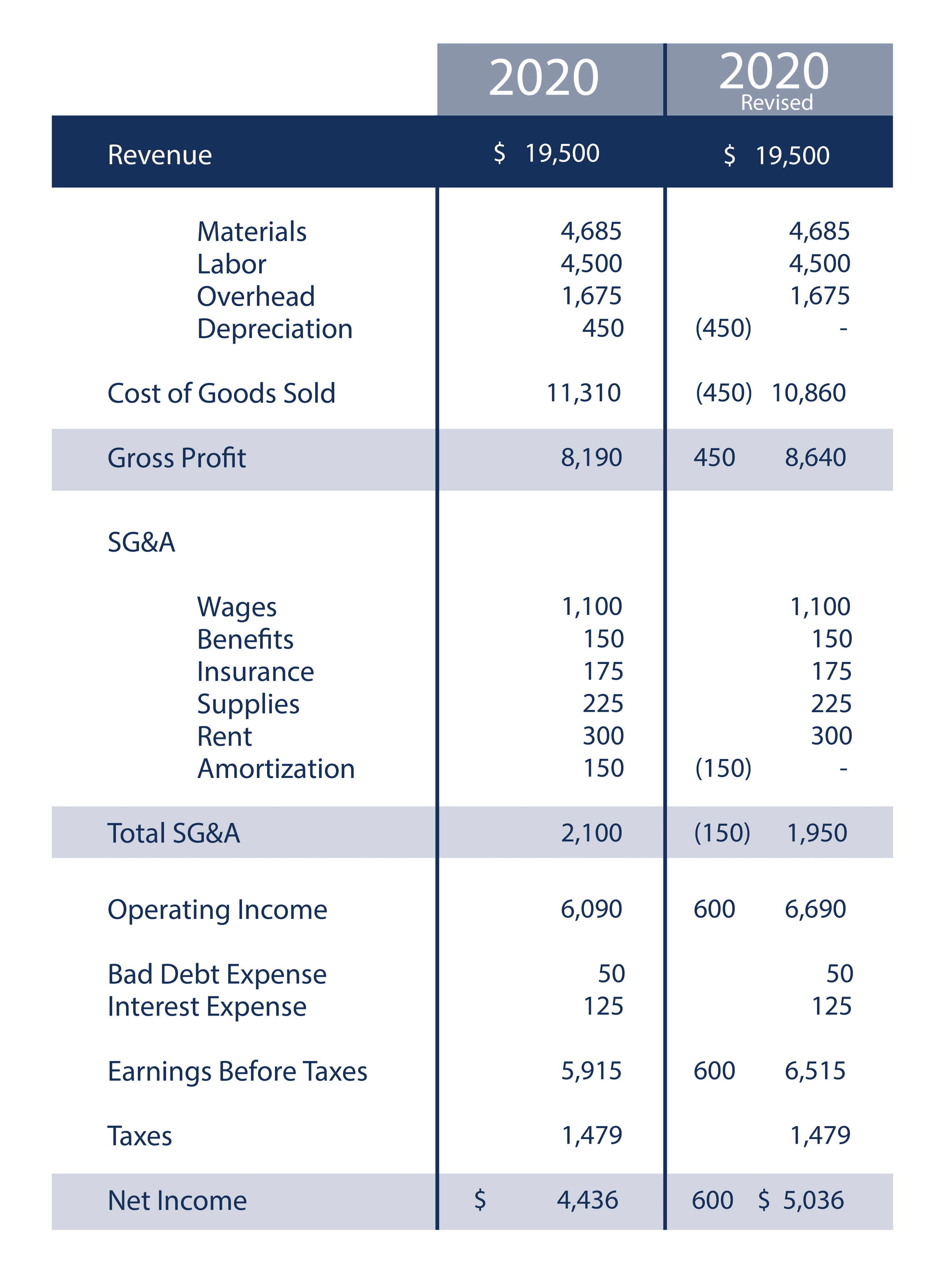

Earnings before interest, taxes, depreciation, and amortization (EBITDA) has become a staple in the world of financial analysis, a shorthand for assessing a company's operational profitability. It's a metric frequently employed to compare the performance of different businesses, particularly those within the same industry. The appeal of EBITDA lies in its ability to strip away the impact of a company's financing and accounting decisions, offering a clearer view of its core operating performance. The formula is straightforward: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.

But how does "Earnings before interest and depreciation" (EBID) function in this landscape?

EBID, as the name suggests, calculates earnings before interest and depreciation, which is a step further from the Net income.

Understanding EBITDA necessitates grappling with its components. Depreciation and amortization, non-cash expenses, reflect the decline in value of a company's assets over time. Interest expense is the cost of borrowing, directly linked to a company's debt load. Taxes, of course, are the levies imposed by governments. By excluding these, EBITDA purports to provide a 'cleaner' picture of a company's ability to generate earnings from its core operations.

The formula for EBID is: Net Income + Interest + Depreciation.

The company income statement serves as the foundation for calculating operating income, the starting point for EBITDA. Analyzing the income statement is paramount, as it details the revenue and expenses that drive a company's financial performance.

However, a critical caveat accompanies the use of EBITDA: it is not a substitute for net income. While EBITDA provides valuable insights, it has inherent limitations. It can mask crucial information about a company's financial health, such as its debt burden, tax liabilities, and capital expenditures.

One should remember to find your mortgage repayment schedule.

EBIDA, sometimes mentioned, which stands for Earnings Before Interest, Depreciation, and Amortization. EBIDA is a measure of earnings that adds interest, depreciation, and amortization to net income. It is more conservative than ebitda, which also adds back taxes. The formula is as follows: Net Income + Interest + Depreciation + Amortization.

EBITDA is a measure of core corporate profitability that excludes depreciation and amortization expenses. Its a metric that excludes interest, taxes, depreciation, and amortization to evaluate a company's operating performance. It is a measure of a company's profitability before interest, taxes, depreciation and amortization. It is widely used to assess the operating performance of a business, but it has limitations and variations.

Another term that has gained traction over the years is EBIDA. It is short for earnings before interest, depreciation, and amortization. EBIDA is a useful measure that provides insight into a company's operational efficiency and profitability.

"Ebit i ebitda" are indicators of profitability of the main commercial activities of the company. The main difference between EBIT and EBITDA is that EBIT subtracts depreciation costs from net profit, while EBITDA does not.

EBITDA is a financial metric that allows you to assess the operational efficiency of a company, abstracting from its capital structure, tax policy, and investments in fixed assets.

EBITDA, or "earnings before interest, taxes, depreciation, and amortization," is a management balance used in American accounting to assess the profitability of the company's operating cycle, independently of its investment or financing policy.

Generally, it can be used in two ways and, by adding a third method, we introduce the application of EBITDA: (1) analysis of investors: (2) investment decisions.

EBITDA is a measure of a company's earnings without the impact of these four expenses. It is one of the operating measures most used by analysts.

There are several metrics available to measure profitability. EBITDA is an indicator of a company's financial performance and is used to determine a company's earning potential.

With EBITDA, factors such as debt financing, as well as depreciation and amortization expenses are excluded.

Earnings before interest tax depreciation and amortization is one of the indicators of business success of a company with an emphasis on liquidity, which takes into account amortization as a non-cash expense.

The calculation of income called EBITDA is one of the best ways to compare the financial strength of two companies.

EBITDA, while offering a valuable perspective, is not a panacea. Its limitations stem from its selective exclusion of expenses. By adding interest, taxes, depreciation, and amortization back to net income, EBITDA can sometimes paint a more optimistic picture of a company's financial health than is warranted. For example, a company with a high debt burden will appear more profitable on an EBITDA basis than on a net income basis, potentially masking its vulnerability to interest rate fluctuations or economic downturns.

Furthermore, EBITDA does not account for the significant investments a company makes in its assets. Depreciation and amortization, which are excluded from EBITDA, reflect the decline in value of those assets. A company with aging or poorly maintained assets may appear profitable under EBITDA, but it could face significant capital expenditure requirements in the near future. This is an example of a flaw when assessing companies with significant capital investments, as it can overstate cash flow and profitability.

Despite these shortcomings, EBITDA remains a popular metric. Its appeal lies in its ease of calculation and its ability to provide a snapshot of a company's operational performance. It is frequently used for comparing companies within the same industry, as it removes the effects of different accounting methods and financing structures. The focus on operating performance makes EBITDA a useful tool for assessing a company's ability to generate cash from its core business activities.

In the complex world of finance, where understanding a company's true financial standing is crucial, EBITDA is but one piece of the puzzle. Investors and analysts would be well-advised to consider it in conjunction with other financial metrics, such as net income, free cash flow, and debt levels, to get a comprehensive view of a company's performance.

However, EBITDA does include the direct effects of financing decisions in that the taxes a company pays is a direct consequence of its use of debt.

Let's consider a few examples:

Company A has high debt and significant interest expense, but relatively low depreciation and amortization. Its EBITDA might be impressive, but its net income will be lower due to the interest burden.Company B operates in a capital-intensive industry, with substantial depreciation and amortization expenses. Its EBITDA may be lower than that of Company A, even if it is generating similar revenues. However, if Company B has recently made significant capital investments, its EBITDA may not fully reflect its long-term growth potential.

The formula for ebitda margin is: EBITDA / total revenue.

EBITDA, when used in valuation, is commonly used in the multiples approach, where a company's value is estimated based on its EBITDA multiple. This multiple is derived from the average EBITDA multiple of comparable companies or transactions.

EBIDA, which stands for Earnings Before Interest, Depreciation, and Amortization. EBIDA is a measure of earnings that adds interest, depreciation, and amortization to net income.

EBITDA can also be used to assess the ability of a company to service its debt. The EBITDA-to-interest ratio is a key metric in this regard. A high ratio indicates that a company has ample cash flow to cover its interest expenses.

EBITDA is not the only metric, and it has its drawbacks. The omission of items like depreciation and amortization can give a misleading picture of a company's profitability.

EBITDA is widely used in assessing the operating performance of a business, but it has limitations and variations. The calculation of EBITDA can vary depending on the accounting standards used. Furthermore, companies may manipulate EBITDA by making adjustments to non-operating items, potentially distorting the true picture of the company's financial performance.

In the world of financial analysis, a myriad of metrics are available to assess a company's performance, each with its own strengths and weaknesses. The popularity of EBITDA highlights the importance of understanding its uses, its limitations, and its position relative to other measures.

The company income statement can be used to calculate operating income.

It is important to understand which expenses are included and which items are excluded.

As the financial landscape continues to evolve, so too will the methods used to analyze companies. Staying informed about these metrics is key to the financial health of any company.

In conclusion, while EBITDA is a valuable tool, it must be used with caution. It's a starting point for understanding a company's financial performance, not an end-all-be-all measure. A comprehensive financial analysis requires looking beyond EBITDA to the full financial picture, including net income, cash flow, and other relevant metrics.